| Audit / Assurance |

Statutory Audit |

The statutory audit is carried in accordance with the provisions of Indian Companies Act, 2013,or any other Act as may be applicable, Indian Accounting and Auditing Standards as may be applicable, and in accordance with IFRS, US GAAP and other guidelines issued by the Institute of Chartered Accountants of India.

|

| Tax Audit |

- Carrying out Tax Audit in compliance to requirements of Indian Income Tax Laws

- Providing disclosures of relevant information in specified formats.

|

| Transfer Price Audit |

- Carrying out “Transfer Price Audit” in compliance to requirements of Income Tax Act

|

| FCRA Audit |

- Audit of Foreign Grants received by the organization as per provisions of FCRA Act.

|

Audit of Trust, Cooperative Societies & NGO's |

- Audit of

- Trust

- Co-operative societies

- NGO's

- providing disclosures of relevant information in specified formats

|

Internal Audit |

- Internal audit to help adding value and improve an organization's operations and bottom line.

- Internal Audit covering

- evaluate and improve the effectiveness of risk management

- Internal Control

- Governance processes

- Cost Cut Exercises

|

Other Audits

|

- System & Management audit

- Concurrent Audit and Income & Expenditure audit

- Information System and Data Verification Audits

- Due diligence

- Stock Audit

- Investigation Audit

|

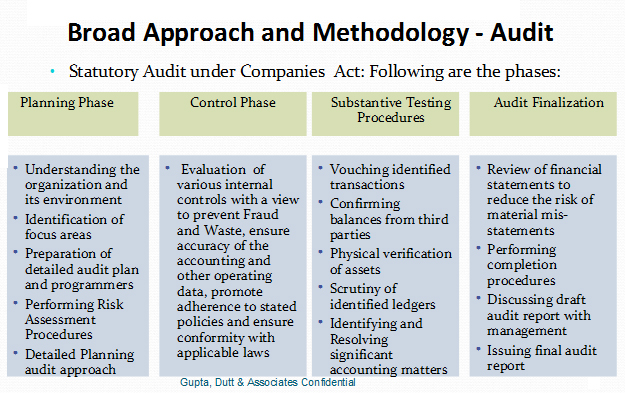

Broad Approach and Methodology - Audit |  |